FOCUS ON AG

September 28, 2020

CFAP 2 PAYMENT DETAILS ANNOUNCED

USDA has announced details for enrollment for the second round of payments for the Coronavirus Food Assistance Program (CFAP2). This program will authorize up to $14 billion in direct payments to farmers and ranchers to partially help offset the financial impacts that U.S. farmers and ranchers have incurred as a result of the COVID-19 pandemic. The CFAP2 aid package is in addition to the CFAP1 payments that many producers have already received for crops, livestock, and specialty crops.

Following is a brief overview of sign-up details and payment calculations for the CFAP2 payments:

CFAP Enrollment -Sign-up for the CFAP program began on September 21 and will continue through December 11, 2020 at local Farm Service Agency (FSA) offices. Currently, some FSA offices are open for business by phone appointment only. Once FSA has verified CFAP eligibility, producers may be able to complete the application on-line. The CFAP application tool and forms will be available at: www.farmers.gov/CFAP

Other CFAP2 requirements – For producers that normally enroll in farm programs or utilize other FSA services, the FSA offices likely already have most of the background information needed to apply for CFAP payments. For producers that are new to utilizing FSA programs and services, they will need to supply the FSA office with name, address and personal information, as well as business structure, adjusted gross income verification, direct deposit information, and conservation compliance.

Covered Commodities

- Row Crops with Price Triggers -Corn, soybeans, wheat (all classes), sorghum, barley, sunflowers, and upland cotton.

- Flat-Rate Row Crops -Alfalfa, amaranth grain ,buckwheat, canola, ELS cotton, crambe (colewort), einkorn, emmer, flax, guar, hemp, indigo, industrial rice, kenaf, khorasan,

millet ,mustard, oats, peanut, quinoa, rapeseed, rice, sweet rice, wild rice, safflower, sesame, speltz, sugar beets, sugarcane, teff, and triticale.

- Livestock -Cattle, hogs, sheep, dairy (milk), broilers, turkeys, goats, bison, buffalo, wool, and eggs.

- Specialty Crops -Sweet corn, peas, fruits, vegetables, nuts, aquaculture, and other specialty crops.

For a complete list and payment details, go to: www.farmers.gov/CFAP

- Commodities Not Covered – Non-alfalfa hay, clover, grass, cover crops, forage sorghum, and home vegetable and flower gardens.

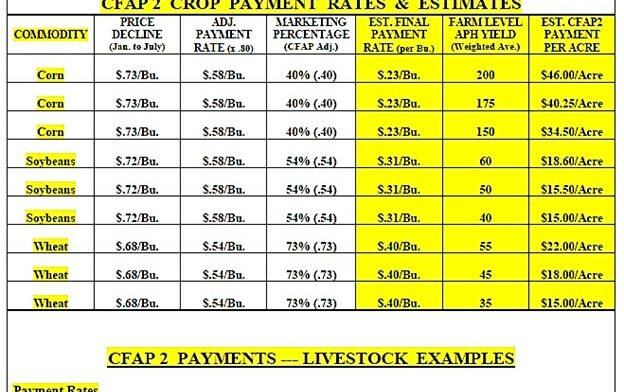

Field Crop payment rates – The final CFAP2 payment rate for a given is based on the price decline from mid-January until late July, 2020, times 80% (.80), which is then multiplied by the percentage of the 2020 crop that is expected to be marketed by year-end.

Following are the approximate final payment rates for common crops:

- Corn — $.58 per bushel x 40% (.40) = $.23 per bushel

- Soybeans — $.58 per bushel x 54% (.54) = $.31 per bushel

- Wheat — $.54 per bushel x 73% (730) = $.40 per bushel

- Barley — $.54 per bushel x 63% (630) = $.34 per bushel

- Sorghum — $.56 per bushel x 55% (.55) = $.31 per bushel

- Sunflowers — $.02 per pound x 44% (.44) = $.009 per pound

CFAP2 Crop payment calculations

- Payments for field crops will be based on the 2020 crop acres that were certified at FSA offices.

- Crop yields will be the “weighted” average APH yield for all farms included in a FSA farm unit.

- Farms without APH yield data will use the County ARC-CO benchmark yield x 85% (.85).

- The minimum payment rate for all field crops, including all “flat rate” crops, is $15 per acre.

- CFAP2 crop payment examples ……

Corn -500 acres x 180 Bu./A. APH x $.23/Bu. = $20,700 CFAP2 payment (est.)

Soybeans -500 acres x 50 Bu./A. APH x $.31/Bu. = $7,750 CFAP2 payment (est.)

CFAP2 Livestock payment rates and calculations

- Hogs -$23 per head times 5,000 head inventory = $115,000 CFAP2 payment (est.)

- Cattle -$55 per head times 500 head inventory = $27,500 CFAP2 payment (est.)

- Sheep –$27 per head times 800 head inventory = $21,600 CFAP2 payment (est.)

The livestock count eligible for CFAP2 payments for all species is the number of eligible head in

inventory on a specific date selected by the producers between April 16 and August 31, 2020.

Breeding stock is not eligible for CFAP2 payments.

CFAP2 Dairy payment rates and calculations

The Dairy CFAP2 payments will be calculated in two parts, which will be added together …

1) The actual certified milk production from April 1 through August 31, 2020 times $1.20 per cwt.

2) The estimated milk production from September 1 through December 31, 2020, based on the daily average production from April 1 to August 31, 2020 times 1.22, which is then multiplied by a payment rate of $1.20 per cwt.

Example -1 million pounds of milk marketed from April 1 to August 31, 2020; 1.22 million pounds

of milk production estimated from September 1 through December 31, 2020. 22,200 cwt. of production times $1.20 per cwt. = $26,640 CFAP2 payment

Payment Limits – Following are payment limits that apply to CPAP2 payments:

- $250,000 per individual or entity or all commodities.

- A corporation or partnership may have payment limits for up to 3 individuals, for a total of $750,000, provided that they meet eligibility requirements.

- A person must have an adjusted gross income of less than $900,000 to be eligible.

Other details on the CFAP2 payments – Potential CFAP 2 payment eligibility will not be impacted by previous payments for CFAP1 or any other government assistance payments previously received in 2020, including any potential 2019 or 2020 farm program payments. Payments through CFAP are direct payments to producers of crops, livestock, and specialty crops and do not have to be repaid.

Where to get more details regarding CFAP2 enrollment and payments

- USDA CFAP2 website at: www.farmers.gov/CFAP

- USDA CFAP2 helpline: 877-508-8364

- Local FSA Offices -Information on CFAP2 program applications, eligible acres, and APH yield calculations are available at local FSA offices. Producers should call their FSA office for details on the application process in their area. For normal field crops, they may be able to accomplish much of the CFAP application process via a phone call with FSA, followed by a subsequent digital signature.

*********************************************************************************

Note — For additional information contact Kent Thiesse, Farm Management Analyst and Senior

Vice President, MinnStar Bank, Lake Crystal, MN. (Phone — (507) 381-7960);

E-mail — kent.thiesse@minnstarbank.com) Web Site — https://minnstarbank.com/